Many web3 users use Revoke.cash as a tool for managing their DeFi wallet‘s various token approvals. However, some users also desire an alternative to safeguard their digital assets. This quest for enhanced security leads to the exploration of tools like De.Fi Shield, which is designed to provide an additional layer of protection.

Today we’ll dive into the functionalities and benefits of these alternatives, while also contrasting the features of De.Fi Shield with Revoke.cash.

What is Revoke.cash?

Revoke.cash was developed initially by Rosco Kalis in 2019. It was mainly aimed at addressing a gap in the web3 user experience: the safe management of token approvals, which at the time had already been credited as the cause of numerous rug pulls and DeFi scams.

At the time, as smart contracts were increasingly integrated into DeFi applications, users were commonly required to give permissions to spend their tokens – often without limits, and often as a routine popup in their wallet that was quickly dismissed. Revoke.cash provided a straightforward solution for users to review and revoke these permissions, reducing the risk of unauthorized access to their assets.

As the DeFi TVL exploded during DeFi summer, so did the scope for scams, and thus, so did the need for Revoke.cash and similar tools. Kalis started working on the project full-time in 2022, enhancing the platform’s capabilities with additional features like a browser extension and an updated dashboard. The platform is sustained through community support, including donations and sponsorships, and maintains a commitment to open-source development, reflecting its role as a public tool for maintaining wallet security within the web3 ecosystem.

De.Fi Shield: Premier Revoke.cash Alternative

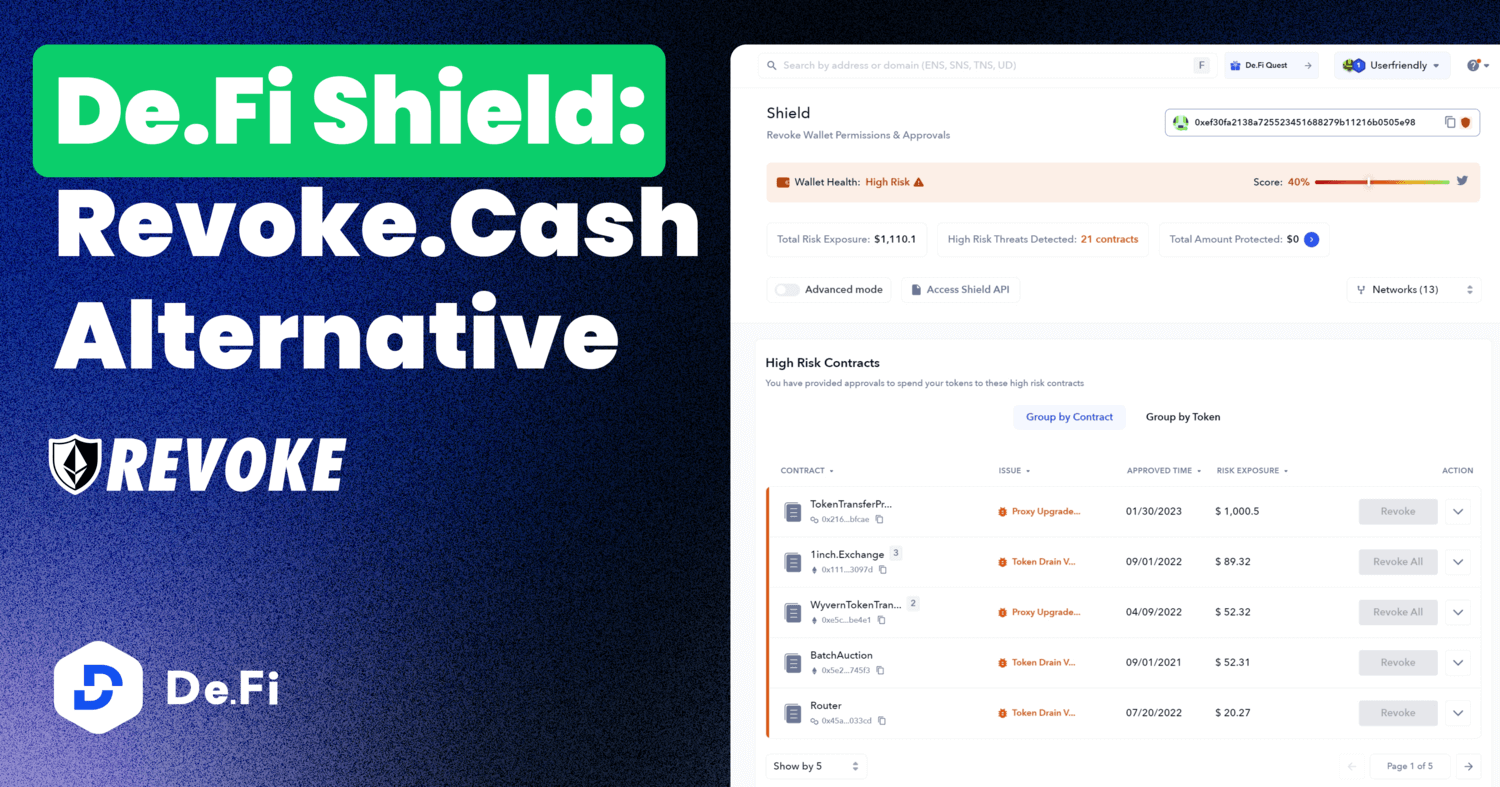

De.Fi Shield serves as a complete Revoke.cash alternative. Equipped with features that cater to the security-conscious DeFi user, the platform is built around a ‘Wallet Health’ score which provides a straightforward rating system for users to assess the security status of their wallets at a glance. This metric is key to users who want to ensure their wallets are not compromised by unnecessary permissions that could be exploited.

TRY SHIELD NOW

The Wallet health assessment categorizes risks into four levels: “High Risk,” “Medium Risk,” “Low Risk,” and “Informational” based on the type of underlying smart contract issue as well as the magnitude of the potential loss. These labels help users prioritize which permissions need immediate attention and simplify the often complex data associated with blockchain and smart contract interactions.

A key feature that enhances the usability of De.Fi Shield is its filter capability. Users can sift through permissions and risks based on their concerns, allowing them to manage their wallets more efficiently. Whether it’s sorting by token type or by the level of access granted, the filter option provides a customized experience.

In terms of blockchain support, De.Fi Shield covers a variety of chains, recognizing the multichain reality of today’s DeFi ecosystem. We don’t simply analyze Ethereum, users have access to a free scan of approvals across Arbitrum, BNB Chain, Polygon, and 9 other popular EVM chains.

This cross-chain functionality ensures that users can maintain oversight of their assets across different networks from a single interface, a significant advantage for those who engage with multiple DeFi platforms.

De.Fi Shield’s capabilities extend to identifying various types of potential exploits. For each potential vulnerability discovered, the service provides detailed reports. These reports are crucial for users to understand the nature of the risk and how it might affect their digital assets.

Once high-risk contracts are identified, you have the opportunity to revoke them one by one or to revoke them all at once:

Choosing to revoke will trigger a pop-up that confirms the action and provides approximate gas fee data for the task:

Hitting “Revoke” once again will then trigger an approval process within your wallet:

Once these transactions are approved, you’re all set! De.Fi Shield will update with your new and improved wallet health score free of risky permissions:

TRY SHIELD NOW

For developers, we also offer a DeFi API to build features for automated protection. The API allows for seamless integration into third-party services or custom-built applications, providing the means to automatically respond to threats. This automation is particularly valuable for users who manage multiple wallets or those who run platforms requiring high levels of security.

Revoke.cash vs De.Fi shield

For those seeking an alternative to Revoke.cash, we believe De.Fi Shield presents itself as a competitive option, especially for those who need to revoke wallet permissions regularly and monitor their DeFi interactions for potential security issues. While Revoke.cash is primarily a token approval tool, the De.Fi Web3 SuperApp offers a complete DeFi dashboard.

This means that, alongside managing token approvals, users can seamlessly track their portfolios, research yield farming opportunities, scan DeFi tokens for vulnerabilities, and review the history of DeFi hacks all in one place. Our support of various chains also means that users aren’t limited to a single blockchain, which is essential as the DeFi ecosystem continues to grow and diversify.

The De.Fi Web3 Antivirus Suite

Beyond its function as a Revoke.cash alternative, De.Fi’s suite of security features offers users comprehensive web3 protection. A standout feature is the Scanner, an automated smart contract auditor tool. This tool scrutinizes smart contracts not just for coding vulnerabilities but also for risks related to tokenomics, governance, and liquidity — critical areas often overlooked in standard security checks. The Scanner’s thorough approach gives users peace of mind by ensuring that the contracts they interact with are examined for a wide array of potential issues.

TRY SCANNER NOW

Moreover, De.Fi’s commitment to user education is embodied in the REKT Database. This repository provides insights into past crypto hacks and scams, enabling users to learn from historical security breaches. Understanding the intricacies of these incidents is vital, as it helps De.Fi users stay vigilant against similar schemes.

The ability to monitor a portfolio with De.Fi sets it apart from other portfolio managers. With its real-time scanning and alert system, De.Fi allows users to keep a close watch on their investments for any signs of unauthorized access or potential exploits. This ongoing surveillance is essential in the dynamic DeFi space, where new threats can emerge rapidly.

Utilizing De.Fi for portfolio management means users benefit from an integrated view of their security posture across all their DeFi engagements. The app’s interface presents a clear picture of which assets may be at risk and offers tools to take immediate action, such as revoking wallet permissions that may have been extended to questionable contracts.

By offering tools to audit, monitor, and learn De.Fi empowers users to take control of their security in a landscape where staying informed is just as crucial as having robust technical defenses. This is the kind of multi-faceted security solution that De.Fi users have come to rely on, setting a new standard for what a portfolio manager can offer in terms of protection and education.

Enhance Your Web3 Education With De.Fi

De.Fi equips web3 investors, HODLers, and degens alike with tools and resources aimed at enhancing their security and knowledge of the space. It’s a comprehensive platform for those looking to navigate the crypto space safely.

Follow the De.Fi YouTube channel and reviewing the De.Fi Security X profile, users can access the latest security updates and industry-leading educational content. Stay informed about the best practices for protecting your digital assets with De.Fi!