Willy Woo, a respected Bitcoin on-chain analyst, is bullish on the world’s most valuable cryptocurrency. Taking to X on March 4, the analyst said BTC can soar to as high as $125,000 by the end of 2025.

This optimistic outlook hinges on increased institutional adoption, particularly from investment giants Blackrock and Fidelity. Notably, Woo suggests that even a minimal 3% allocation to Bitcoin by clients of these firms could push the price past $125,000.

For context, the analyst highlights Blackrock’s $9.1 trillion assets under management (AUM) and Fidelity’s $4.2 trillion AUM. These figures are used with Blackrock and Fidelity’s most optimistic portfolio allocation recommendations of around 84.9% for Blackrock and 3% for Fidelity.

Even with this figure, Woo emphasizes that this projection is “very conservative.” In response, the analyst notes this only factors in a small fraction, roughly $13.3 trillion, of the total global wealth estimated at $500 trillion.

Bitcoin supporters are overly confident, believing that widespread adoption by institutional investors could be triggered by Fidelity and BlackRock’s endorsement of the asset.

While Woo says the coin can easily float to over $125,000 by the end of 2025, most are bullish. In their predictions, even a 1% allocation of the $500 trillion in global wealth can drive Bitcoin to as high as $300,000.

BTC Likely To Break $70,000: What’s Next?

Over the past few months, Bitcoin has been on a tear. For context, the coin soared from around $27,000 in October 2023 to above $63,000 when writing in early March. However, what’s evident is that the acceleration from late January 2024 has been noteworthy. The coin is likely to double, going at the current pace, rising from around $40,000.

So far, buyers are setting their eyes on the all-time high of about $70,000 recorded in late 2021. Considering the deluge in demand and the sharp expansion in prices throughout February, most analysts believe BTC will ease past this level and edge toward $100,000.

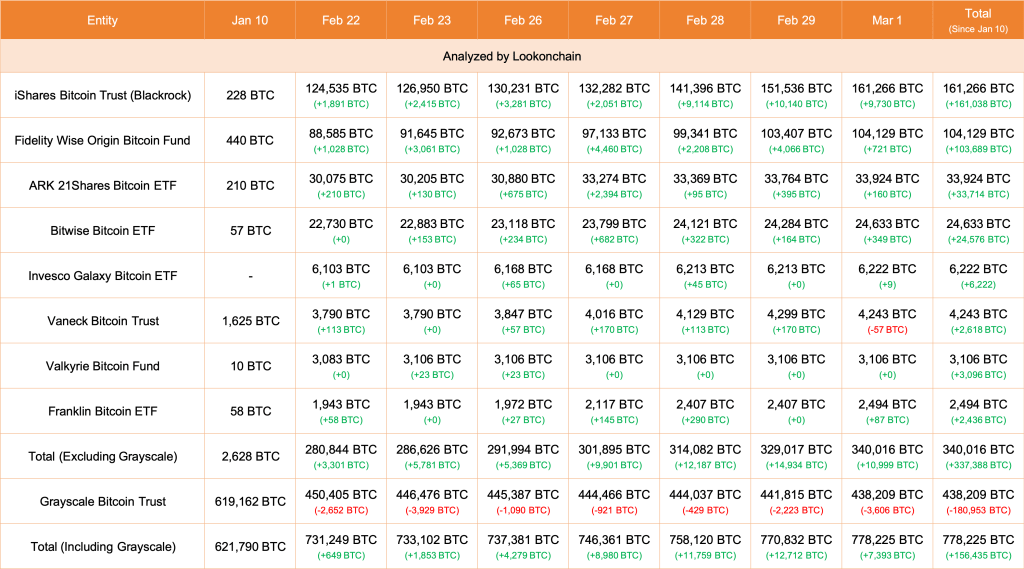

The race to $100,000 is primarily fueled by spot Bitcoin exchange-traded fund (ETF) issuers ramping up their coin purchase. As of March 1, Lookonchain data shows that eight spot Bitcoin ETF issuers had added 10,999 BTC worth over $680 million, spearheaded by BlackRock. The asset manager bought $601 million of BTC on behalf of its clients.

Feature image from Canva, chart from TradingView