On-chain data shows the Bitcoin mining difficulty has gone through an increase of more than 10% in the latest network adjustment.

Bitcoin Mining Difficulty Has Seen A Sharp Increase In Latest Adjustment

The “mining difficulty” is a core feature of the Bitcoin blockchain that basically exists to control the inflation of the cryptocurrency. While BTC’s supply has a cap, it hasn’t been reached yet, so the asset’s supply is continuously going up.

Miners “mint” new BTC by solving blocks on the network and receiving block subsidies as compensation. These rewards always have a fixed BTC value attached to them, except for during Halving events, which take place about every four years and permanently slash them in half.

As such, the only way to increase the production rate of the token is by producing blocks faster. Miners can do this by adding extra computing power, thus increasing their total “hashrate.”

This effect, however, lasts only momentarily, thanks to the existence of the difficulty. In a universe where the BTC network didn’t have the difficulty built into it, miners could simply keep on raising the hashrate to mint the asset faster, thus eventually leading the coin’s value to succumb to high inflation.

Our Satoshi had the foresight to see this problem and programmed the Bitcoin blockchain so that it targets a standard block production rate of 10 minutes per block.

Whenever the miners deviate from this rate, either by decreasing their hashrate or by increasing it, the BTC network changes the difficulty just enough to counteract the change in the hashrate. These adjustments take place about every two weeks and are entirely automatic.

While a constant block production rate doesn’t do anything to make inflation lesser (which would make the coin scarcer), it certainly makes it predictable. The Halving event mentioned earlier is what exists to do the job of making the production rate tighter.

The latest Bitcoin network adjustment occurred just recently and significantly upped the difficulty, as the below chart shows:

The value of the indicator appears to have seen a sharp spike recently | Source: CoinWarz

This sharp difficulty adjustment to a new all-time high (ATH) would imply a rapid increase in the hashrate has also occurred, and the chart for the 7-day average hashrate confirms this.

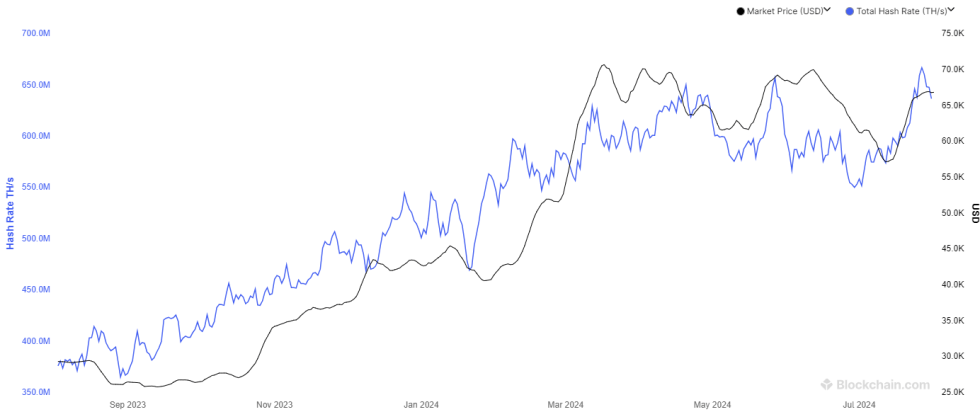

Looks like the value of the metric has seen a sharp increase in recent days | Source: Blockchain.com

As is visible in the above graph, the 7-day average Bitcoin hashrate set a new record recently. This sharp jump in computing power meant miners were pumping out blocks at a much faster rate than the network intends, so it upped the difficulty by more than 10% to slow down the miners back to the standard pace.

BTC Price

At the time of writing, Bitcoin is floating around $64,000, down almost 3% over the past 24 hours.

The price of the coin seems to have been going down over the last few days | Source: BTCUSD on TradingView

Featured image from Dall-E, CoinWarz.com, Blockchain.com, chart from TradingView.com